Chartered Business Accountant in Practice (CBAP)

Your practice. Your clients. Your authority to operate

Many people start doing private accounting work, helping friends with tax returns, doing bookkeeping for a few small businesses, or setting up companies.

But without a professional designation, you:

Can’t legally do certain work (like tax advice or independent reviews)

Struggle to win bigger, better-paying clients

Risk making mistakes that could put you, and your clients, in trouble

CBAP changes that. It gives you formal recognition, legal protection, and the credibility that clients and regulators trust.

Become a CBAP

Join now and receive

the essential credential

for career development

South Africa

R5860 Per Year

Namibia

R6950 Per Year

PART

Start Your Practice, Get the CBAP

Your side hustle becomes a recognised profession.

What CBAP Means

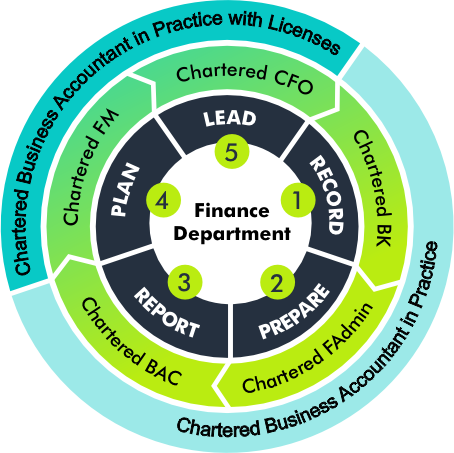

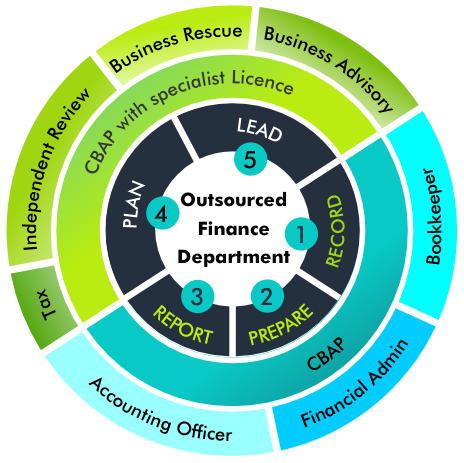

CBAP tells the market you’re a qualified, ethical professional who can offer accounting, accounting officer and tax compliance services in your own name.

PART

Grow Your Practice, Add a Licence to your CBAP

The work you really want. The fees you really deserve.

Why a Licence Matters

Some work is restricted by law, like giving tax advice, performing assurance work, or handling business rescues. Without the right licence, you can’t legally do it, and you’ll lose clients to those who can.