Build your independent career in practice, from Bookkeeper to Licensed Specialist.

CIBA gives you the designations, licenses, and backing to win better clients, grow your firm, and deliver trusted services to SMEs, NPOs, and communities.

Why This Matters

Running a practice means more than compliance , it’s building trust, growth, and independence for clients and yourself.

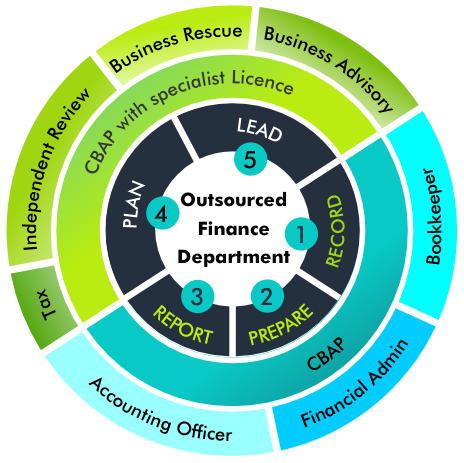

The Practice Career Pathway

Path: Bookkeeper → Accountant in Practice → Licensed Specialist (Tax · Independent Review · Business Rescue)

Trainee Accountant (in practice)

Keep clients compliant and cashflow stable.

You’ll do: books, VAT, payroll, CIPC updates, basic management reports.

You’ll need: accuracy, client communication, standardised workflows.

Next step: Accountant in Practice.

Accountant-in-Practice (AIP)

Your clients’ outsourced finance partner.

You’ll do: monthly management accounts, forecasts, SARS engagements, advisory.

You’ll need: reporting, tax basics, pricing, engagement letters, tools.

Next step: Licensed Specialist.

Your Designation Levels (Practice)

Chartered Bookkeeper (CBK) → bookkeeping services with credibility.

Chartered Business Accountant in Practice (CBAP) → full outsourced finance; advisory.

CBAP + Licences → add specialist authority (Tax, Independent Review, Business Rescue).

Why it helps: clients choose you over nondesignated providers; fewer disputes; you can standardise pricing and grow a team.

Licensed Specialist (addon licences)

Sell highvalue services with formal recognition.

Options:

Tax Practitioner (Advisor) — tax planning, objections/appeals, represent with SARS.

Independent Reviewer — Companies Actrecognised review engagements.

Business Rescue — turnaround plans, stakeholder management.

(Optional addons your clients may need: immigration/visa financial reports, finance for NPOs, farmers, legal practitioners, creative artists.)

Licences & What They Allow

Tax Practitioner (Advisor): tax advice, submissions, represent clients with SARS.

Independent Reviewer: perform review engagements for qualifying companies.

Business Rescue: appointed to rescue distressed entities.

Other specialist reports: e.g., immigration/visa financials for Home Affairs.

Practice Building Toolkit Provided by CIBA

Proposal & engagement letter templates

Pricing calculators for monthly packages

Practice management software discounts

PI insurance cover and ethics guidance

Memberonly referrals via chambers & partnerships

“Becoming a CBAP turned my hustle into a business. Clients take me seriously and I’ve added an Independent Review licence for higher value work.”

— Sipho M., CBAP

FAQs (Commerce)

-

Yes, your designation proves level, not sector only.

-

Yes, career resources and reference letters.

-

No, designations complement qualifications and experience.

Start Your Chartered Journey Today

No long process. No risk. Recognition that lasts a lifetime.

Apply online in minutes. Flexible payments. Cancel anytime