Chartered Business Accountant in Commerce (CBAC)

You don’t just work in finance, you take the numbers, make sense of them, and give management the clarity to make the right calls..

Why Become a Chartered Business Accountant in Commerce?

At this level, you own the accounting process. You make sure the books are accurate, deadlines are met, and management gets the financial insights they need.

Can manage the full accounting cycle

Keep the business compliant with tax and statutory deadlines

Turn financial data into actionable insights

The CBAC designation tells employers you:

Become a CBAC

Join now and receive

the essential credential

for career development

South Africa

R2900 Per Year

Namibia

R4525 Per Year

Steps to becoming a Chartered Business Accountant in Commerce?

-

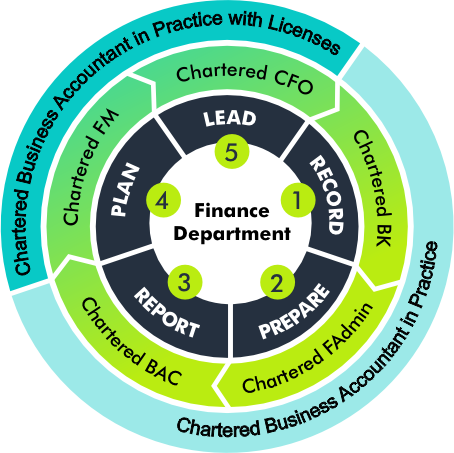

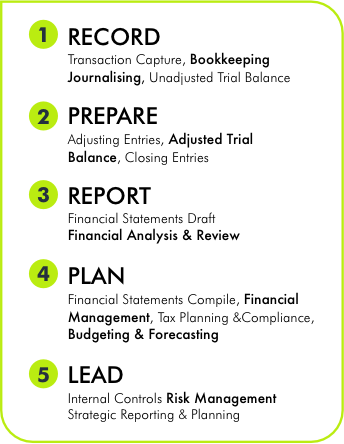

Every finance department has different levels:

Functional: Data capturing, invoice processing

Administrative: Reconciliations, VAT returns, month-end support

Operational: General accounting and reporting

Management: Oversees teams, budgets, forecasting and compliance

Strategic: Sets direction, leads finance strategy, advises the board

CBAC is the designation for the Operational level of the Finance Department.

When you’re ready, it’s your stepping stone to:

-

CBAC is for you if:

You’re already preparing budgets, financial statements, or tax returns

You want recognition for your skills and impact on the business

You’re aiming for a management or senior accounting role

Minimum requirements:

National Diploma or Degree in Accounting/Finance, or Recognition of Prior Learning (RPL)

3 years’ experience in accounting, tax, or finance work

-

CBACs are trusted to manage the core accounting and reporting functions:

Prepare and review financial statements

Manage budgets and forecasts

Oversee tax compliance (VAT, PAYE, income tax)

Support audits and liaise with auditors

Analyse performance and present insights to managementYou’re the bridge between the finance team and business decision-makers.

-

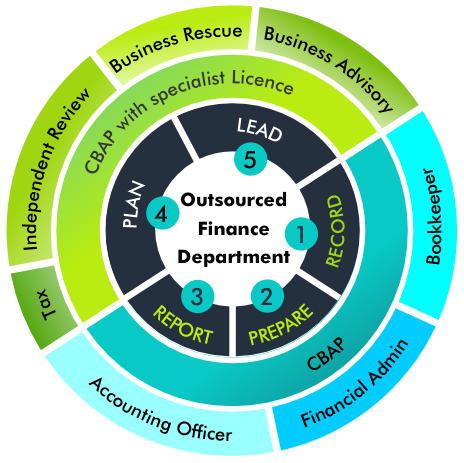

Some work requires additional rights or licensing:

Act as an Accounting Officer in private practice

Perform Independent Reviews for companiesIf you want to work for yourself or provide services to the public, your next step is Chartered Business Accountant in Practice (CBAP).

-

Becoming a CBAC is straight-forward:

1. Become a member

Create your profile and sign-up as a CIBA member at myciba.org

2. Apply for the CBAP designation

Upload ID, CV, and proof of qualifications (or RPL evidence)

Provide two reference letters and complete your experience assessment

Pay your designation fee (monthly or annual)

Get evaluated and receive your CBAC certificate

-

Stay recognised and credible by:

Completing 20 hours CPD per year

· Completing an annual ethics course to lock in CIBA rewards

Completing CIBA’s Professional Readiness Programme (once-off)

-

CBAC isn't just another designation, it's the start of professional respect.

Professional recognition at operational level

Your name listed on the National Database of Accountants

A title that signals competence, credibility, and commitment

A clear pathway to management and leadership roles

-

Most finance professionals hit the same wall, you’ve got the skills, but you’re stuck fighting for recognition, missing out on opportunities, or being overlooked for bigger roles.

CIBA changes that.

Through partnerships with national industry bodies, like ANNET (NPO sector), SACCI (business chambers), Creative Artists, Agriculture, and the legal profession, we:Put your name in front of employers who value CIBA designations.

Train their finance staff, so they know and respect the CIBA standard.

Create sector-wide demand for members with your qualification.

Instead of chasing opportunities, you’ll have them coming to you.

-

CIBA rewards aren’t perks you buy, they’re recognition you earn.

Only members who stay in good standing, follow our ethics, and deliver quality work get access to them.

When you uphold the standard, you unlock:

No more paying for learning: your ethics, compliance, and technical CPD is free every year.

Pay less for specialist skills: big discounts on advanced courses, licenses, and short programmes.

Help when you’re stuck: direct access to our technical desk, templates, and guides.

People knowing your worth: your name listed in the National Database of Accountants and featured in member spotlights.

The right connections: from annual conferences to sector-specific networking events.

A say in the rules: we fight your corner with SARS, CIPC, UIF, CIDB, DSD and others so you’re not ignored.

For practice members (CBAP): PI cover, software discounts, and direct client leads so you can grow faster.

We even run our own accounts this way, membership fees are recognised upfront, because the rewards aren’t “paid for” month by month. They’re earned by members who live up to the CIBA standard

“I used to be ‘the accounts guy’. Now management sees me as a partner in decision-making. CBAC gave me that credibility.”

— Pieter du Plessis, CBAC