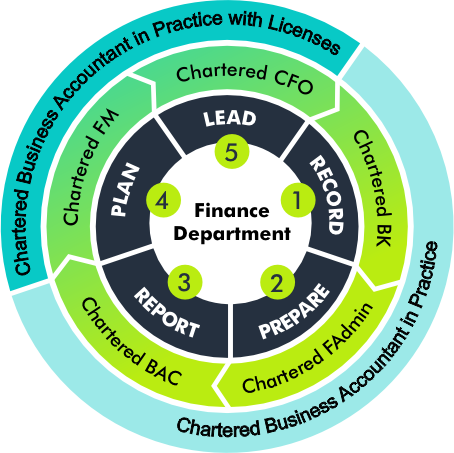

Chartered Business Accountant in Practice

You don’t just offer accounting services. You’re the outsourced CFO that SMEs can trust.

Why Become a Chartered Business Accountant in Practice?

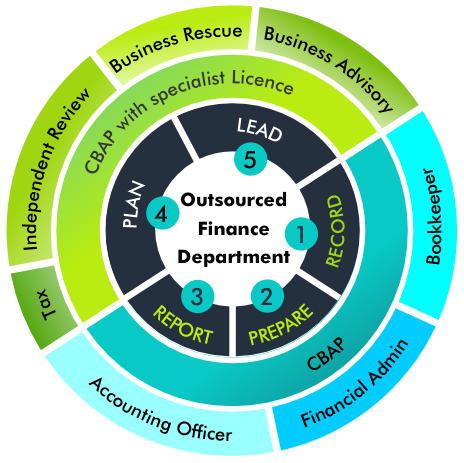

CBAP is the entry point to running your own accounting practice.

Legally recognised to offer accounting and compliance services to the public

Recognised in law to act as an Accounting Officer for Close Corporations, NPOs, and many more.

Recognised in law to register as a Tax Practitioner – Compiler (file returns, no advice)

Gives you a clear path to higher-earning specialist licences

If you’re already doing the work, this is the title that makes it official.

-

SMEs rarely have a full finance team, they need one person who can wear all the hats.

As a CBAP, you’re that person.

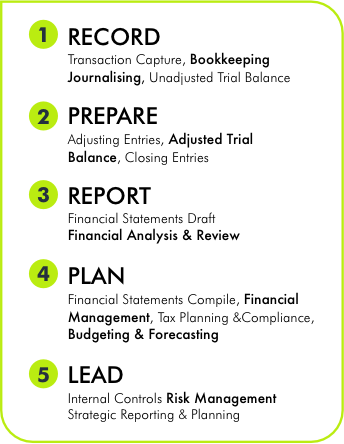

You can handle the full day-to-day finance cycle:

Functional: Capture transactions, process invoices, keep the books in order

Administrative: Manage payroll, VAT returns, reconciliations, and month-end tasks

Operational: Prepare and compile financial statements, file statutory returns, keep the business compliant

You’re the outsourced CFO for SMEs, providing everything they need to stay on track and grow.As a CBAP, you’ll serve clients like:

Companies and Close Corporations (CIPC and SARS compliance)

Schools, churches, and NGOs (financial statements, compliance, governance)

Insurance brokers, estate agencies, and micro-lenders (FSCA/FIC/ NCR reports)

Startups and SMEs needing monthly accounting and strategic guidance

Clients applying for grants, loans, BEE certificates, and funding

CBAPs are the outsourced finance departments for thousands of businesses.

-

CBAP is for you if:

You want to start your own accounting practice or grow your side business

You may be qualified or self-taught but have proven experience

You want clients, regulators, and banks to take you seriously

Minimum Requirements:

National Diploma, Degree (any field), or Recognition of Prior Learning (RPL)

At least 48 months of accounting, tax, or finance experience

-

Once you’re a CBAP, you can immediately offer general accounting services, including:

Act as Accounting Officer for Close Corporations and NPOs

Submit VAT, PAYE, and income tax returns as a Tax Practitioner: Compiler

Register companies & maintain compliance with CIPC

Compile financial statements & do basic financial analysis

Provide payroll & secretarial services

Draft business plans & funding proposals

Help with cashflow and debt management

These are essential services that help SMEs stay afloat, and you’re already trusted to deliver them.

-

Some work requires additional licensing and without the license you may not perform the work.Theseinclude higher-risk, regulated services, like:

Tax advisory

Independent review

Issuing immigration reports

Business Rescue

To do them you will need to add a CIBA Practice License.

These licenses unlock new revenue streams and prove that you're legally qualified to offer specialist services. -

Become a member

Create your profile and sign-up as a CIBA member at myciba.org

Apply for the CBAP designation

Upload ID, CV, and proof of qualifications (or RPL evidence)

Provide 2 reference letters & complete your experience assessment

Do a verbal assessment with a CIBA evaluator

Pay your designation fee (monthly or annual)

Get evaluated & receive your CBAP certificate

-

Stay recognised and credible by:

Completing 40 hours CPD per year

Completing an annual ethics course to lock in CIBA rewards

Completing CIBA’s Professional Readiness Programme (once-off)

-

CBAP isn’t just a piece of paper, it’s your authority to operate.

Recognition as a professional accountant in practice

Your name listed on the National Database of Accountants

Legal authority for Accounting Officer & Tax Practitioner: Compiler work

A clear pathway to specialist licences and higher earnings

-

Most finance professionals hit the same wall, you’ve got the skills, but you’re stuck fighting for recognition, missing out on opportunities, or being overlooked for bigger roles.

CIBA changes that.

Through partnerships with national industry bodies, like ANNET (NPO sector), SACCI (business chambers), Creative Artists, Agriculture, and the legal profession, we:

Put your name in front of employers who value CIBA designations

Train their finance staff, so they know and respect the CIBA standard

Create sector-wide demand for members with your qualification

Instead of chasing opportunities, you’ll have them coming to you.

-

CIBA rewards aren’t perks you buy, they’re recognition you earn.

Only members who stay in good standing, follow our ethics, and deliver quality work get access to them.When you uphold the standard, you unlock:

No more paying for learning: your ethics, compliance, and technical CPD is free every year.

Pay less for specialist skills: big discounts on advanced courses, licenses, and short programmes.

Help when you’re stuck: direct access to our technical desk, templates, and guides.

People knowing your worth: your name listed in the National Database of Accountants and featured in member spotlights.

The right connections: from annual conferences to sector-specific networking events.

A say in the rules: we fight your corner with SARS, CIPC, UIF, CIDB, DSD and others so you’re not ignored.

For practice members (CBAP): PI cover, software discounts, and direct client leads so you can grow faster.

We even run our own accounts this way — membership fees are recognised upfront, because the rewards aren’t “paid for” month by month. They’re earned by members who live up to the CIBA standard.

When you uphold the standard, you unlock:

No more paying for learning: your ethics, compliance, and technical CPD is free every year.

Pay less for specialist skills: big discounts on advanced courses, licenses, and short programmes.

Help when you’re stuck: direct access to our technical desk, templates, and guides.

People knowing your worth: your name listed in the National Database of Accountants and featured in member spotlights.

The right connections: from annual conferences to sector-specific networking events.

A say in the rules: we fight your corner with SARS, CIPC, UIF, CIDB, DSD and others so you’re not ignored.

For practice members (CBAP): PI cover, software discounts, and direct client leads so you can grow faster.

We even run our own accounts this way, membership fees are recognised upfront, because the rewards aren’t “paid for” month by month. They’re earned by members who live up to the CIBA standard

Become a CBAP

Join now and receive

the essential credential

for career development

R1953pm

for 3 months

“Becoming a CBAP transformed my practice, from a hustle to a business. Clients take me seriously now, and I finally feel like a professional.”

— Sipho Mahlangu, CBAP