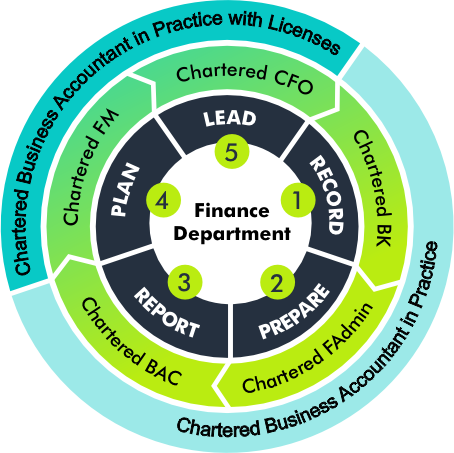

Chartered Business Accountant in Practice plus License

From general accountant to specialist, and higher earnings.

Once you have your CBAP, you can take on more complex, regulated work, but only with the right licence. This is specialist territory: higher risk, stricter rules, and bigger rewards

Without a licence and only the CBAP, you can:

Compile financial statements

File tax returns as a Tax Practitioner: Compiler

Act as an Accounting Officer for Close Corporations and NPOs

With a CBAP designation + licence, you can:

Give tax advice as a Tax Practitioner: Advisor

Handle regulated forensic work

Provide assurance services that the law protects for qualified, licensed accountants only

Handle in-depth business advisory work

Think of it like moving from a general doctor to a specialist surgeon — same profession, but different authority, recognition, and reward.

CBAP + License: Higher Trust, Higher Pay

If you're ready to take on regulated work, the kind that comes with legal responsibility and higher earnings, you’ll need to apply for one or more of CIBA’s specialist licenses:

Tax Practitioner

Tax is one of the most regulated areas in South African accounting, and it's also one of the most rewarding.

To offer any tax service to the public, you must be registered with SARS and a Recognised Controlling Body (RCB), such as CIBA.

Tax Practitioner – Advisor License (Tax Planning and Structuring)

-

Often billed per submission or on retainer

High-volume, high-trust work — especially during tax season

Advise on business structures and tax strategies

Guide SMEs on allowable deductions and deferrals

Assist clients with dispute resolution and objections

Requires deeper tax law understanding and stronger communication skills

Often billed at a premium rate — especially during reviews or audits -

Required to conduct Independent Reviews under the Companies Act.

Needed by thousands of SMEs that don’t require audits

Lower cost than audits — high demand from small companies

Requires strong IFRS and assurance understanding -

Needed for regulated tasks in immigration, banking, BEE, and financial services.

Required for affidavits, compliance reports, and third-party confirmations

High trust and discretion required

Often short turnaround, premium billing -

Apply to be listed for rescue appointments under the Companies Act.

High-risk, high-reward engagements

Requires judgment, strategy, and experience -

Offer comprehensive CIPC, shareholder, and governance services.

Useful for startup packs, restructuring, and company law compliance

Pairs well with monthly retainer clients -

Investigate financial fraud, misconduct, and internal control failures.

Used in legal disputes, disciplinary hearings, and fraud detection.

High-trust, high-skill work that protects clients — and the public interest.

Required by law to file any tax return or give tax advice.

What You Get with a CIBA License

Legal standing in the applicable regulated area

Advanced CPD training and guidance

Templates, tools, and engagement letters

Listing as a Licensed Professional on CIBA's official register

Eligibility for PI insurance

Technical and legal support when you need it

“I used to just submit VAT and do books. After getting my Independent Review license, I doubled my average invoice and started working with bigger clients.”

— Lucky Madlala, CBAP (Licensed Reviewer)

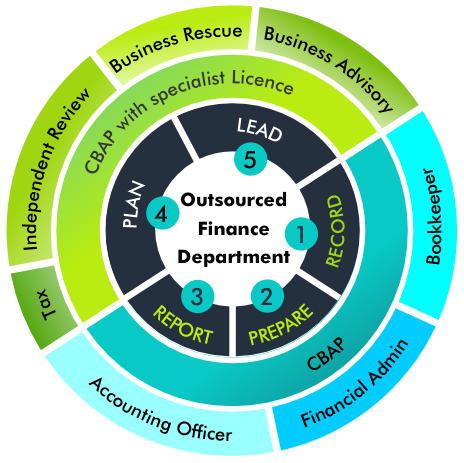

Choose Your Path. Build Your Practice. Expand Your Authority.

-

What You Can Do - Basic accounting, payroll, tax prep, officer reports

Risk - Low

Billing Potential - (Low–Mid)

-

What You Can Do - File returns, advise on tax structures

Risk - Medium

Billing Potential - (Mid–High)

-

What You Can Do - Sign Independent Review reports

Risk - High

Billing Potential - (High)

-

What You Can Do - Issue reports to banks, embassies, regulators

Risk - High

Billing Potential - (Mid–High)

-

What You Can Do - Appointed to run business rescues

Risk - Very High

Billing Potential - (Very High)

-

What You Can Do - Offer full company secretarial and governance services

Risk - Medium

Billing Potential - (Mid)

-

What You Can Do - Forensic services to clients

Risk - High

Billing Potential - (High)