Login

Use LinkedIn or an email

or

Signup for free

Use LinkedIn or an email

or

Reset password

Enter email to reset password

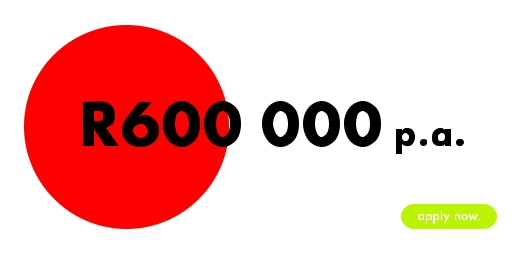

Earn more by starting your own practice as a certified Business Accountant.

Step out on your own.

Our Business Accountant in Practice (SA) designation is recognised in more than 10 statutes and regulations, this designation makes you an accountant in practice. Typical roles eligible for the designation include: Accounting officer, tax practitioner, compiler, prepared, assurance provider, business advisor.

Qualifying for a BAP(SA):

- Commerce based National Diploma or Degree from an accredited institute of higher learning, that includes the 5 following subjects: Accounting III, Auditing II, Tax II, Management Accounting II, Corporate Law II

- If your qualifications did not include the above you may be eligible to write a CIBA accredited assessment based on RPL

- NQF7 or higher

Experience:

- 4 years relevant experience in finance department specific to accounting and tax, or 3 years as a trainee in practice

- Experience will be verified by way of a logbook completed by employer and correlation with credit bureaus

Assessment:

- Complete a course and assessment in ethics

- Completion of the CIBA Annual Practice License.

Private Practice:

- BAP(SA) holders may act in private practice e.g. only BAP(SA) holders are allowed to act as accountants in private practice or as accounting officers

- A SAQA recognised designation

- Statutory recognition as an Accounting Officer

- Statutory recognition as a Commissioner of Oaths

- Statutory recognition as an Independent reviewer

- Statutory recognition as a Business Rescue Practitioner

- Recognition as a certified Accountant in Practice

- Recognition as a Business Advisor

- Recognition as a Management Consultant

- Recognition as a Tax Practitioner through our mutual recognition agreement with SAIT

- Exemption to CIMA level 1 and level 2

- Access to job opportunities

- Access to clients

- Marketing and promotion

- Access to accounting news and developments

- Networking opportunities

- Personal and professional development seminars and free webinars

- Pathway to specialist licenses