Knowledge Centre

1. Going Concern Concept

A qualification gets you in the door. A designation keeps you in the game — and makes sure people pay you what you’re worth.

2. Explainer Video (top of page)

1–3 min video from a staff member or subject expert explaining:

What the topic is

Why members should care

How it connects to their work, compliance, or earning power

3. What You Need to Know

A business is considered a going concern when it is expected to continue operating for the foreseeable future, usually at least 12 months after the reporting date without the intention or necessity of liquidation or material curtailment of operations. Management must assess whether the entity can continue to meet its obligations as they fall due under IFRS or IFRS for SMEs.

4. Why It Matters to You

Determines basis of preparation of financial statements.

Influences asset valuations, liabilities, and disclosures.

Auditors and accountants must evaluate management’s assessment and disclose uncertainties.

5. Frameworks, Standards

IFRS for SMEs, Section 3: Financial Statement Presentation

ISA 570 (Revised): Going Concern

CIBA Practice Guidance Notes for Small and Medium Practices

6. How to Apply

Common “Going Concern” Indicators

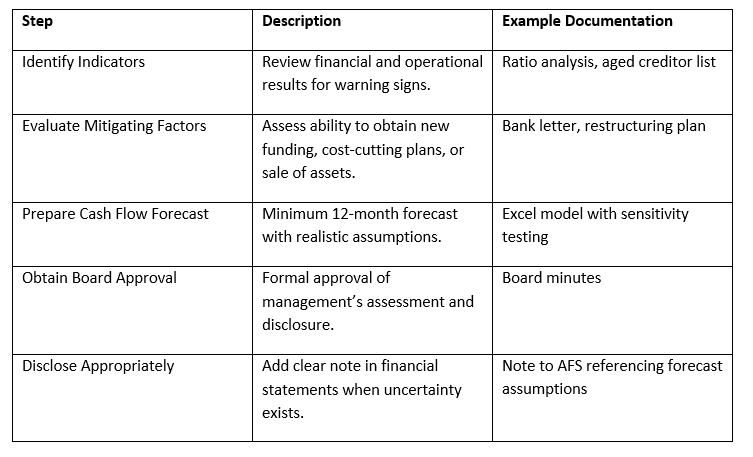

7. Management’s Assessment – Documentation Guide

8. Independent Accountant’s Role

Independent Business Accountant must evaluate management’s assessment for reasonableness, perform procedures to identify further events, and conclude if material uncertainty exists with appropriate disclosure.

9.Practical Checklist for Small Business Accountants

✅ Review current and prior year financials.

✅ Analyse 12-month cash flow forecasts.

✅ Check loan covenant compliance.

✅ Evaluate funding and shareholder support.

✅ Document management representations.

✅ Update assessment at sign-off date.

10. Disclosure Examples

If no significant doubt:

“The financial statements have been prepared on a going concern basis as management believes the entity will continue to meet its obligations for the foreseeable future.”

If material uncertainty exists:

“These financial statements have been prepared on a going concern basis. However, a material uncertainty exists which may cast significant doubt on the entity’s ability to continue as a going concern.

11. Tips for Practitioners

• Encourage early identification of risks.

• Maintain a standard working paper template.

• Reassess post-balance-sheet events before sign-off.

• Document management’s rationale even for low risk.