Accountant

Thinking About Becoming an Accountant? Let’s Break It Down..

If you're already managing ledgers, reviewing journal entries, and preparing reports for decision-makers, then you're not “just in finance,” you're the heartbeat of business performance.

This is the step where your work moves from processing to interpreting. From rules to judgement. From data to value.

Accountants are the translators of financial data. They ensure accuracy, compliance, and clarity in reporting—turning numbers into insight.

Compile financial statements and monthly management accounts

Interpret and explain variances and cash flow trends

Assist in budgeting, forecasting, and year-end processes

Ensure regulatory and tax compliance

Support decision-making by presenting financial insights

“Accountants don’t just close the books. They open the conversation.”

Where Do Accountants Work?

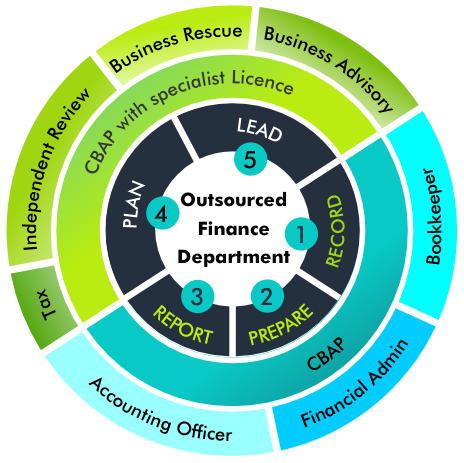

You’ll find business accountants in almost every sector—because every business needs someone who understands what the numbers mean.

Corporate finance teams (large and small)

Audit and accounting firms

NGOs and public benefit organisations

Universities and educational institutions

Government departments and municipalities

Freelance and outsourced CFO services

What Skills Do You Need?

Here’s what employers and clients expect at this level:

Strong grasp of IFRS and tax principles

Proficiency in accounting systems (e.g. Sage, Xero, SAP, QuickBooks)

Analytical and reporting skills

Ability to explain finance to non-financial people

Integrity, professional judgement, and attention to detail

You're the bridge between data and decisions.

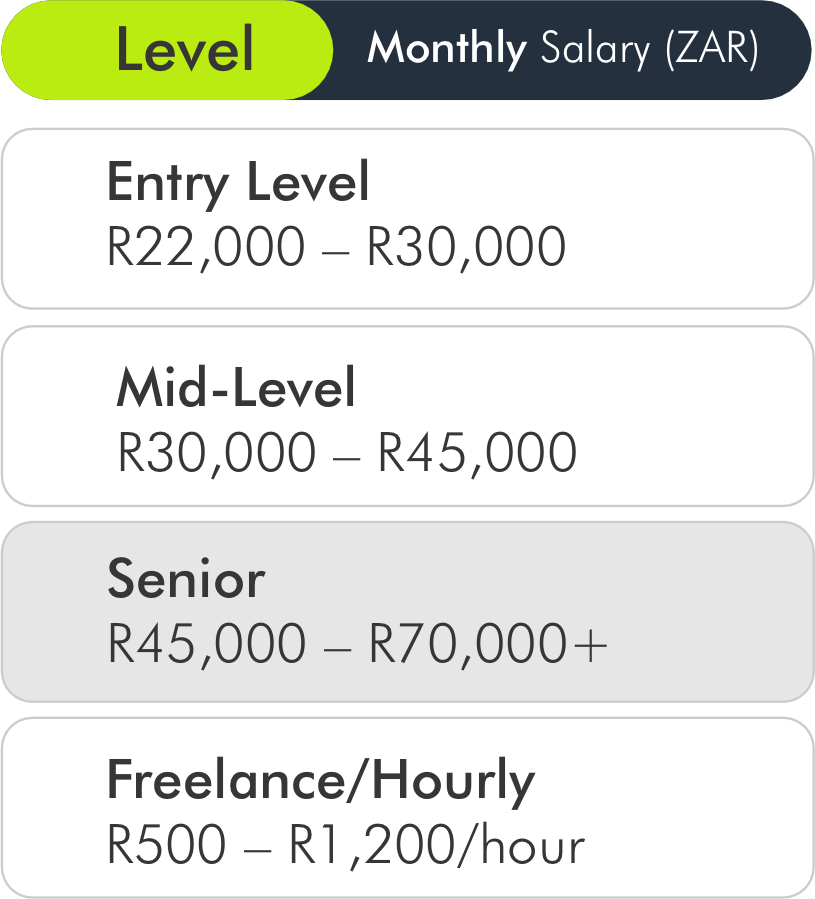

How Much Do Accountants Earn?

Accounting salaries reflect technical skill, responsibility, and your ability to communicate with management:

Holding a designation like CBAC increases your trustworthiness, and your rates.

What Skills Do You Need?

Here’s what employers and clients expect at this level:

Strong grasp of IFRS and tax principles

Proficiency in accounting systems (e.g. Sage, Xero, SAP, QuickBooks)

Analytical and reporting skills

Ability to explain finance to non-financial people

Integrity, professional judgement, and attention to detail

You're the bridge between data and decisions.

What Skills Do You Need?

Here’s what employers and clients expect at this level:

Strong grasp of IFRS and tax principles

Proficiency in accounting systems (e.g. Sage, Xero, SAP, QuickBooks)

Analytical and reporting skills

Ability to explain finance to non-financial people

Integrity, professional judgement, and attention to detail

You're the bridge between data and decisions.

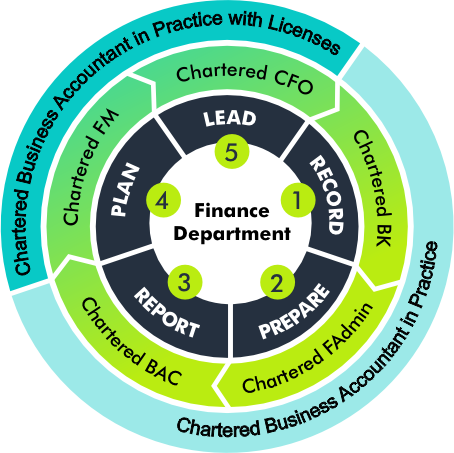

What’s the Career Path?

Most financial professionals follow a journey like this:

Start → Bookkeeper or Financial Administrator

Next → Business Accountant (CBAC)

Then → Financial Manager or Financial Controller

Eventually → CFO, Sector Specialist, Consultant, or Entrepreneur

CBAC is the foundation for moving into senior management roles.

The CIBA Way

Let’s be honest. A lot of brilliant accountants get stuck without the title or recognition. Employers overlook them. Clients undervalue them.

That’s why we created the Chartered Business Accountant in Commerce (CBAC) designation.

A designation built for real-world commerce

Recognises both your academic and workplace achievements

Shows that you’re committed to ethics, CPD, and professional standards

Helps you stand out to employers, clients, and regulators

You’ve put in the work. Now claim the title that reflects it.

Ready to Take the Next Step?

Start your journey toward Chartered recognition as a Business Accountant in Commerce (CBAC). It’s how you prove your value—and increase it